Banks in Switzerland

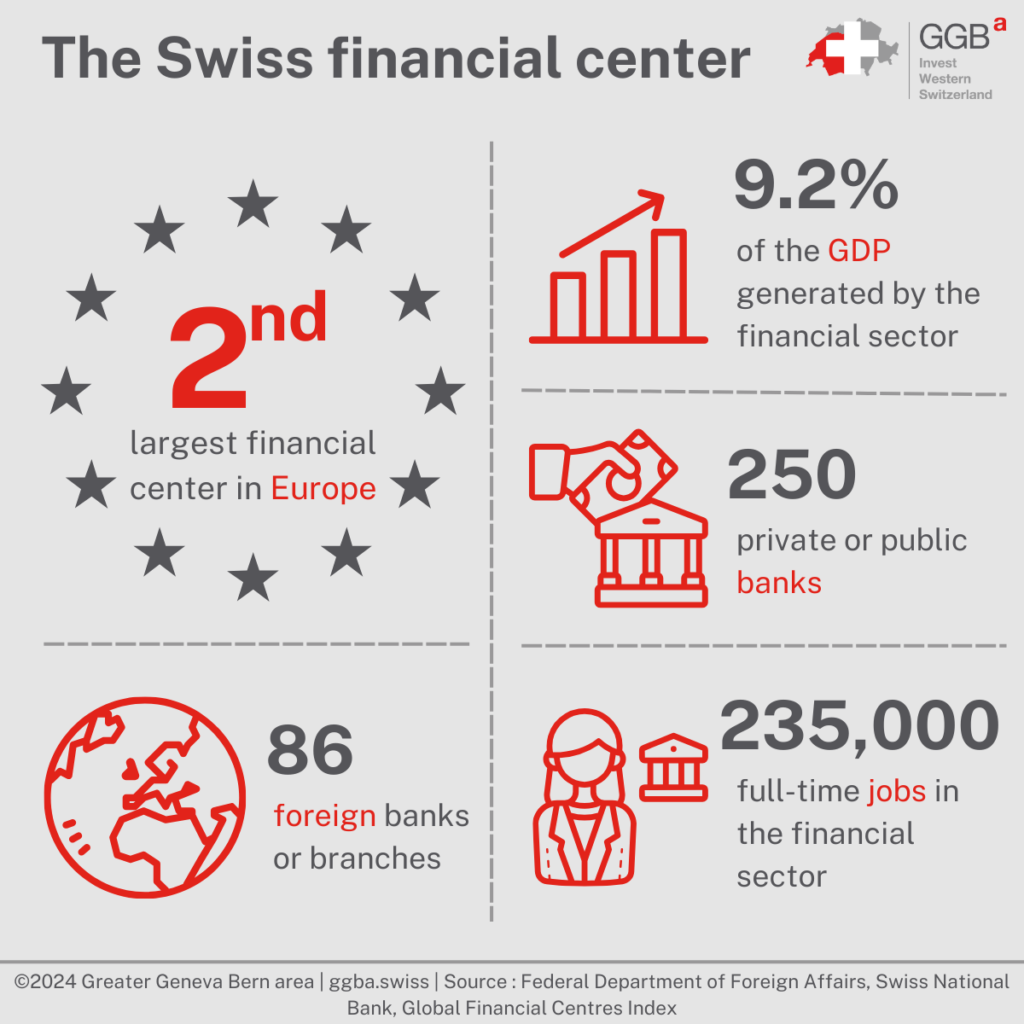

Insurance companies, banks, and pension funds are pillars of the Swiss economy. They generate almost 10% of the gross domestic product and contribute significantly to the competitiveness of the Swiss financial center.

A brief description of Swiss financial center

Switzerland is a prime location for companies and individuals looking to invest their money safely. It has many financial institutions, including the large international bank UBS, as well as smaller private banks offering specialized services such as commodity trade finance. In addition, the 24 cantonal banks account for about a third of the country’s business and are guaranteed by the federal government. Switzerland also attracts foreign banks, with nearly 86 foreign banks (or branches) operating in the country. The country is particularly renowned for its professional wealth management, with global leadership in cross-border wealth management as of 2018.

A multifactorial stability

The success of the Swiss financial center is the result of a combination of many factors. First of all, the country’s political and macroeconomic stability appears to be a prerequisite for gaining client confidence in the financial sector. This stability attracts investors who seek to avoid the risks associated with political uncertainties.

The Swiss franc also contributes to the stability of the Swiss financial center. The Swiss National Bank, which is responsible for maintaining price stability, uses various monetary policies to achieve this goal, including adjusting interest rates and intervening in the foreign exchange market.

Finally, market participants can manage assets and risks profitably and diversify internationally thanks to a highly globalized network and efficient financial infrastructure.

Banking system’s supervision

Compared to other countries, the Swiss banking system has relatively few obstacles and regulatory constraints. A license is required to open a bank, trade professionally in securities, manage funds, and in some cases, operate as an asset manager. For information on the requirements to be met, it is necessary to consult the website of the Swiss Financial Market Supervisory Authority (FINMA). FINMA is a Swiss public law corporation that supervises more than 500 financial institutions. Its role is to protect the clients of the financial markets, namely creditors, investors, and insureds. Through this supervision, it reinforces confidence in the proper functioning, integrity, and competitiveness of the Swiss financial center. However, the Swiss legislature encourages FINMA to promote self-regulation and to give it the necessary space. Therefore, the rules are proposed by the Swiss Bankers Association among others, and FINMA is then in charge of approving and imposing them.

All banks in Switzerland must be licensed. The supervisory standards applied to refer not only to the adequacy of the banks’ equity and capital base but also to the full range of prudential and ethical rules to be observed.

In the event of a concrete complaint about a bank based in Switzerland, clients can contact the Swiss Banking Ombudsman, a neutral and free information and mediation body.

Services offered by Swiss banks

Banks in Switzerland offer a wide range of financial products and services to individuals and companies. Since the Swiss banking system is based on the universal banking model, all banks can offer a full range of banking services. Here are some examples of areas of application:

- Credit and active operations;

- Wealth management and investment advice;

- Institutional investments;

- Payment traffic;

- Passive operations;

- Issuance operations;

- Securities transactions;

- Financial analysis.

However, this does not prevent some banking groups from specializing in certain areas.

Opening a bank account in Switzerland

In principle, any adult (18 years old) can open a bank account in Switzerland. However, banks reserve the right to refuse clients. Most Swiss banks do not require a minimum deposit for savings accounts and traditional current accounts.

In addition to Swiss franc accounts, many banks offer accounts in euros, US dollars, or other currencies.

Deposit insurance for banks in Switzerland (esisuisse)

Esisuisse is a self-regulatory organization of banks in Switzerland that ensures the protection of customer deposits. All banks with a branch in Switzerland must be members of this organization. In case of bankruptcy of a bank or a securities dealer, esisuisse guarantees the reimbursement of the clients’ savings up to a maximum amount of CHF 100,000. This guarantee is valid per client and per institution. It thus ensures effective protection of savers in Switzerland.

The function of the deposit guarantee (esisuisse)

If FINMA decides to close a financial institution, the available funds will be used first to immediately repay the privileged deposits. Preferred deposits are deposits up to a maximum amount of CHF 100,000 per client and financial institution (in each currency). If these funds are not sufficient, esisuisse will intervene to repay the guaranteed deposits of the clients. For this purpose, esisuisse obtains the necessary funds from its members (all financial institutions in Switzerland are obliged to be members) using a direct collection procedure and forwards them to the liquidator mandated by FINMA within 20 working days. Esisuisse has a maximum of CHF 6 billion available for this operation. In addition, financial institutions must also maintain liquidity equal to half of their maximum required contributions to esisuisse, in addition to legal liquidity requirements.

In a nutshell: Swiss banks are considered to be very reliable and stable, with strict regulations that guarantee the security of deposits and highly respected confidentiality of bank accounts. This makes them a preferred choice for individuals and companies concerned with protecting and managing their assets.

Greater Geneva Bern area (GGBa) is the investment promotion agency for Western Switzerland. If you would like to know more about banks in Switzerland or about other subjects that could help you set up your business, contact us.

Our “Why Switzerland” articles can answer your questions.