Financing the creation or establishment of your company in Switzerland

Each project of creation or establishment, whether it has a medium or long-term objective, requires initial investments and financing. In Switzerland, various financial aids are available for businesses.

In Switzerland, the diversity and quality of financial service providers offer excellent conditions for corporate clients to find a financing solution tailored to their needs. There is a wide range of options on the market, including conventional offerings such as operating loans, investment loans, and leasing. In addition, investors such as business angels, venture capitalists, and private equities also offer special forms of external financings, such as start-up financing, export financing, trade financing, convertible loans, guarantees, and equity financing. Swiss banks also offer a variety of derivative instruments, such as futures and options, that allow companies to better manage financial risks.

Financing day-to-day operations

Banks provide various forms of short-term loans for financing day-to-day operations. They may grant overdraft credits or require collateral in the form of pledges. Several factors related to the company’s situation determine the credit policy for commercial financing:

- Market activity;

- Cost-effectiveness;

- Development prospects;

- The quality of the management.

These factors are essential for the bank. They allow the bank to evaluate the company’s ability to repay the loan.

With the digitization of industry (Industry 4.0), the requirements for corporate financing are changing. They are more focused on the total redesign of production processes than on the purchase of concrete capital goods. Banks must therefore understand and evaluate business models and their potential in the digital world. Companies, on the other hand, must then be able to provide them with the right information.

Mortgages

The creation or establishment of a company in Switzerland is accompanied by the acquisition of real estate or the construction of a permanent establishment. In this case, the mortgage loan is an essential instrument.

There are three types of mortgages in Switzerland with different interest rates:

- The fixed-rate mortgage: the interest rate is fixed for a specific period (from 1 to 15 years);

- The variable rate mortgage: the interest rate is permanently adapted to the market rate;

- Money market mortgage (also called Libor mortgage): the interest rate is based on the euro reference rate (Libor).

The bank examines the quality of the business and the creditworthiness of the borrower according to its own rules. Generally, the buyer is required to bring at least 20% of the purchase price in equity. In addition, the annual expense generated by the purchase (interest, amortization, and maintenance) must not exceed one-third of the gross income. As interest rates are negotiable, it is advisable to ask for an offer from several institutions.

In the case of commercial properties, pledging is increasingly based on yield value. In classic industrial projects, 50% of the total value of the investment – the market value or construction costs, including machinery and equipment – can be financed at very advantageous conditions against a real estate pledge. For office buildings and service centers, the pledge rate is usually around 70%, although it also varies depending on the risks (inherent in the property). Today, the interest rates and conditions for corporate investment projects depend largely on the creditworthiness of the company and its rating by the lending bank.

Venture capital firms

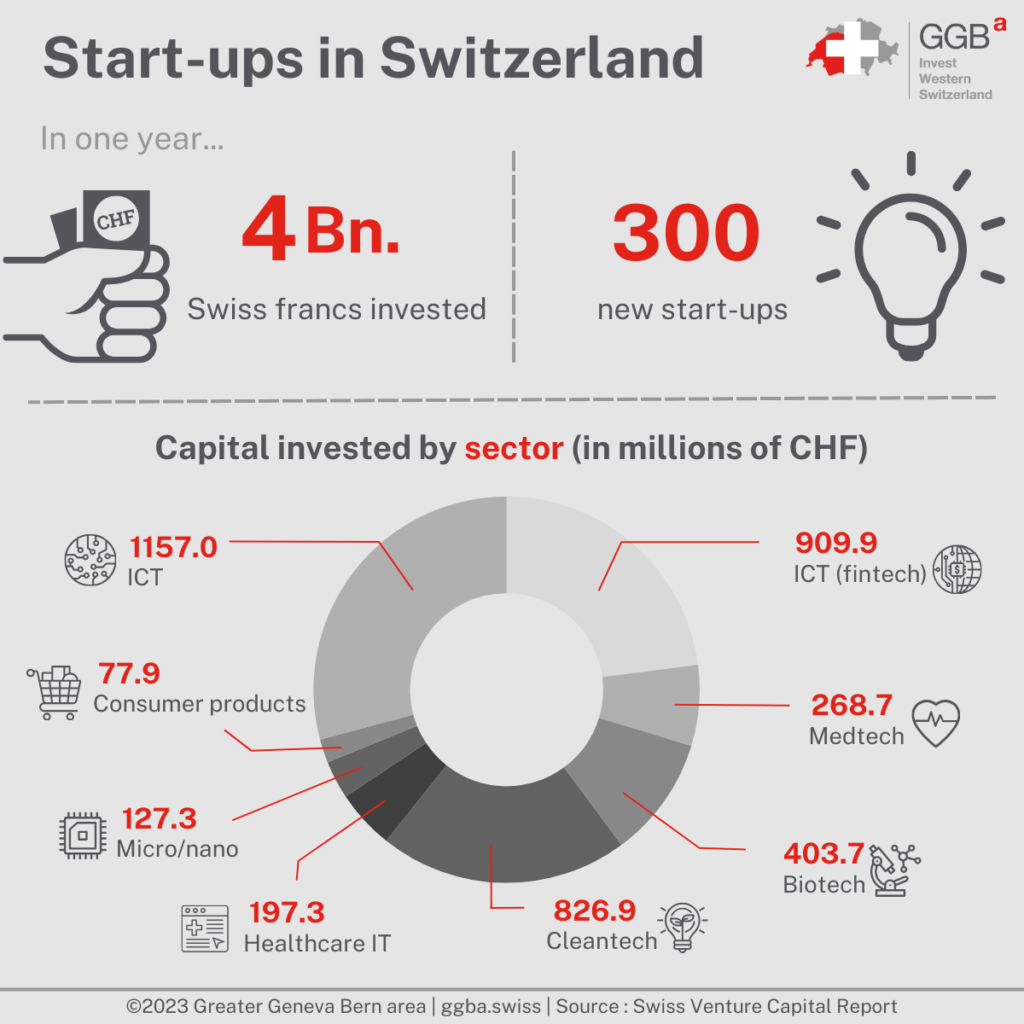

Venture capitalists are a central pillar of Switzerland’s innovation capacity. They participate in the share capital of the company they support and expect to make substantial profits when the company is successful or even listed on the stock exchange. They make their resources available without traditional security measures. In general, venture capitalists only support young, high-growth companies with a high potential for continued growth and sales, and require capital of several million Swiss francs.

These companies assist the new company during the start-up phase of the financing project. Once their task is accomplished, they withdraw and sell their shares to the company’s founders or other investors.

Business angels

Many young companies need less than two million Swiss francs in start-up financing. Yet, in general, the minimum deal size for venture capitalists is high. Few venture capitalists are interested in deals under two million Swiss francs. More and more often, start-ups are financed by individual investors called “business angels“. In addition to their capital, business angels have the experience and contacts to act as advisors and mentors. Like venture capitalists, business angels also have specific return objectives. The operation consists of launching young companies, developing and establishing them, and ultimately making them attractive to future investors. As a result, young entrepreneurs are usually closely accompanied by business angels, who also require access to business plans. You can find tips on how to make a successful business plan on the website of the Swiss Confederation.

Public aids

In addition to focusing on creating favorable framework conditions, Switzerland offers a wide range of business support measures. These measures range from administrative support to tax relief to bonding guarantees.

The cantonal economic development agencies can also facilitate the initial phase or the expansion of a company by providing a building plot at a favorable price or by granting tax relief.

In a nutshell: in Switzerland, there are various ways to obtain financing to help develop your business, whether it is during its launch or its establishment. To find solutions that best suit your company’s needs, we advise you to contact an economic promotion agency such as Greater Geneva Bern area.

Greater Geneva Bern area (GGBa) is the investment development agency for Western Switzerland. If you would like to know more about business financing in Switzerland or other topics that could help you set up your business, contact us.

Our “Why Switzerland” articles can answer your questions.