Switzerland and international trade

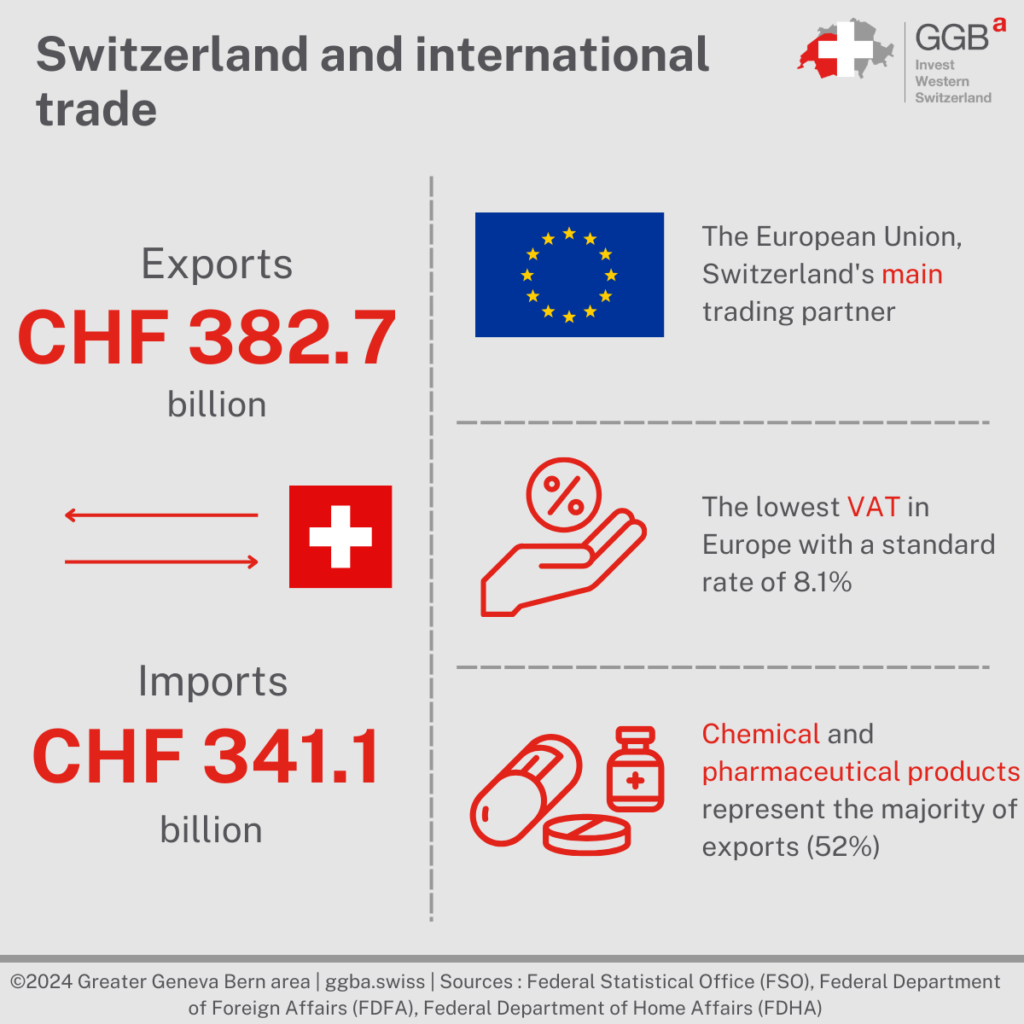

While Switzerland is not a member of the European Union, it is heavily involved in international trade, which allows easy cross-border movement of goods and people. Therefore, there are several foreign economic policy elements to know when trading internationally in goods and services from Switzerland.

Switzerland’s trade agreements with foreign countries

Switzerland’s foreign economic policy aims at open and rule-based free trade to constantly improve access to foreign markets for Swiss companies and goods. There are numerous free trade agreements between Switzerland and other countries, which actively contribute to Switzerland’s economic proliferation:

- The European Free Trade Association Convention (EFTA): this intergovernmental organization aims to promote free trade and economic integration for the benefit of its four member states, Iceland, Liechtenstein, Norway, and Switzerland.

- Bilateral free trade agreements with the European Union (EU): these agreements guarantee broad reciprocal market access and prevent discrimination against Swiss companies on the European domestic market.

- Free trade agreements with partners outside the EU: these agreements allow Switzerland to facilitate trade with countries that are not part of the EU, such as China, Japan, or Canada. You can find this partners’ list on the Swiss Confederation‘s website.

Actions and laws that facilitate international trade in Switzerland

In addition to the various economic agreements established between Switzerland and many foreign countries, Switzerland is also a member of the World Trade Organization (WTO). As a result, it has undertaken to convert most non-tariff trade barriers (that is to say, measures that discourage or limit imports of certain products into Switzerland, such as technical or packaging standards) into customs duties, which are less restrictive for industrial goods’ imports and exports. In addition, industrial goods’ imports and exports are generally exempt from customs duties and quotas on the European markets thanks to free trade agreements, which is a real advantage for trade with the EU. However, one must be careful: despite the exemption from customs duties and quotas, customs clearance is still mandatory. Nevertheless, this step is not an obstacle since it can be done directly online via the IT applications e-dec and NCTS.

There is also a federal law, the Law on Technical Barriers to Trade, which is largely based on the EU’s technical requirements, allowing products legally introduced into the European market to circulate in Switzerland without prior control. In addition, there are no protectionist measures on Swiss products (with a few exceptions such as agricultural products), which promotes the country’s general economic growth.

Going through Swiss customs: everything you need to know

Although Switzerland is a member of the Schengen area, it is not part of the European Customs Union and the common market. Thus, customs control is maintained. You should therefore not forget to bring the essential documents with you when you go through Swiss customs. The most important documents for customs clearance are the customs declaration, which must be accompanied by the exporter’s invoice, with total weight, and proof of origin, where necessary. A certificate of origin is required to benefit from preferential duty rates within the scope of free trade agreements or the Generalized System of Preferences or if the goods are to be re-exported and the origin is to be passed on.

Switzerland has a particularity regarding customs duties which, unlike most countries, are calculated according to gross weight and apply to products for which no duty-free allowance is granted. In Switzerland, the rates are generally lower than in other countries, which favors high-quality goods’ imports with a low weight but high intrinsic value.

Finally, in line with other countries, Switzerland levies taxes and duties at its borders (for example taxes on tobacco and beer, mineral oil tax, etc.). However, it has by far the lowest VAT rate of its neighboring countries, with a standard rate of 8.1%. By comparison, Germany’s standard rate is 19%, France’s rate 20%, Austria’s rate 20%, and Italy’s rate 22%.

The rules of origin

Finally, it is important to understand the rules of origin in order to take full advantage of international trade from Switzerland. Just like a person, each product has a nationality (origin) and an identity document (origin’s proof). The rules of origin thus make it possible to determine a product’s national origin, and to apply the appropriate laws according to the various agreements made between the countries involved. It should be noted that it is possible for raw goods and parts imported from third countries to acquire Swiss origin (that is to say the Swiss Made label) and be delivered duty free to countries with which there are free trade agreements, if they have been sufficiently processed in Switzerland (according to the framework of the corresponding free trade agreement). In many cases, this applies if the added value produced in Switzerland represents between 60% and 80% of the finished product’s selling price. This regulation is particularly interesting for high-quality goods. These often have a low weight but high market value and can therefore be imported into Switzerland at low cost for processing and then be exported to countries with tariff preference, with which there is a free trade agreement.

In a nutshell: thanks to the various measures applied to promote international trade in goods and services, Switzerland is an advantageous country in which to set up a company with international activities.

Greater Geneva Bern area (GGBa) is the investment promotion agency for Western Switzerland. If you would like to know more about international trade in Switzerland or about other subjects that could help you in your implantation, do not hesitate to contact us.