Taxation of businesses in Switzerland

The international comparison of the total tax rate shows that the taxation of legal entities in Switzerland is very advantageous compared to that in other industrialized countries.

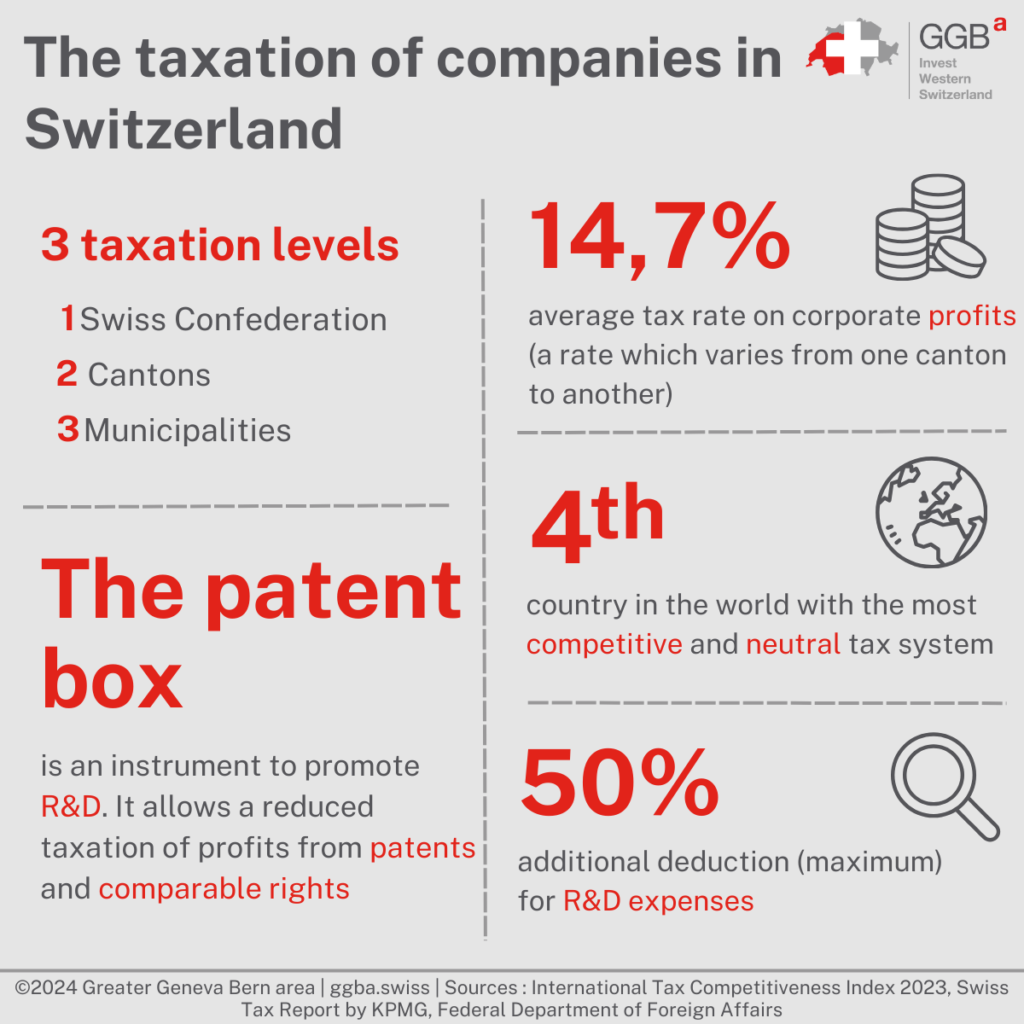

The Swiss tax system reflects the federal structure of the country. Switzerland is made up of 26 cantons, with 2,136 municipalities. The Swiss Confederation gives the cantons full power in matters of taxation, except for taxes under the control of the federal government. Switzerland has three taxation levels: federal, cantonal, and municipal.

Despite the relative independence of the cantons, the 1990 federal law on the harmonization of direct taxes of the cantons and municipalities has made it possible to harmonize the formal aspects of the various cantonal tax laws. This was the case for the determination of taxable income, deductions, tax periods, and assessment procedures. Nevertheless, the cantons and municipalities still have a large degree of autonomy in the quantitative aspects of taxation. The tax burden therefore still varies from canton to canton and from municipality to municipality.

Taxation of legal entities

A legal entity is an entity that has a legal personality, with a name and an address. This legal personality gives it access to rights and obligations. In addition, it must be represented by at least one natural person. The taxation of legal entities is then divided into two levels: the tax on profits (at federal and cantonal levels) and the tax on capital. Here are the main aspects to know about these different taxes.

The federal income tax

The Swiss Confederation levies a flat rate tax of 8.5% on the after-tax profits of companies and cooperatives. The tax rate drops to 4.25% for associations, foundations, other legal entities, and collective investments. In addition, no capital tax is levied at the federal level.

Persons subject to the law

Legal entities subject to federal income tax are, for example:

- Public limited companies;

- Limited liability companies;

- Partnerships limited by shares ;

- Cooperatives;

- Associations;

- Foundations;

- Swiss collective investments with directly owned real estate.

Companies with their registered office or effective management in Switzerland are in principle considered residents in Switzerland for tax purposes.

It should be noted that partnerships companies (general partnerships, limited partnerships, and sole proprietorships) are not taxable as such because they are not legal entities, but individuals. The taxation of individuals is discussed in the article Taxation of individuals in Switzerland.

Taxable income

The profit tax is levied on the worldwide revenues of the resident company in Switzerland, except for revenues attributable to permanent establishments abroad. Non-resident companies are only required to pay tax on Swiss-source profits. The latter concerns profits and capital gains generated by Swiss activities, permanent establishments, or real estate. It should be noted that income from real estate includes income from real estate trading.

The taxable income is determined based on the statutory accounts of the Swiss company. In the case of a foreign company, it is based on the accounts of the branch office. If the arm’s length principle is respected, expenses booked under commercial law are tax deductible (except for certain tax correction provisions). Income from qualifying investments (dividends and capital gains) is indirectly tax-exempt. Losses can be carried forward for tax purposes for up to seven years.

Thin Capitalization Rules

When a company’s equity is insufficient for its debts, it is called “Thin Capitalization”. In Switzerland, the Federal Tax Administration has defined so-called “Safe Harbour Rules” concerning possible external financing, which apply to debts to affiliated companies. Third-party financing is not affected by these rules.

The maximum amount of qualifying foreign equity from affiliates is determined by assigning each asset class a certain minimum equity ratio. This percentage is prescribed and generally based on market value. However, lower book values are usually sufficient.

Liabilities to affiliated companies that exceed the permissible level of indebtedness are considered equity. They are then included in the taxable capital for the annual cantonal and municipal capital tax. However, this does not apply if it can be proven that the financing conditions are following the arm’s length principle. The interest deduction is calculated by multiplying the permissible amount of debt by the maximum rates published by the Federal Tax Administration. If the interest paid to the equity holders exceeds the maximum amounts allowed, the excess will be added to the taxable profit if market conformity is not proven by comparison with third parties. In addition, such disproportionate interest payments are considered a hidden distribution of profits, which is subject to withholding tax.

The absence of group consolidation in Switzerland

Consolidation – which consists of combining the annual accounts of the various companies that make up the corporate group – does not exist in Switzerland. As a result, a system of separate taxation of entities applies for income tax purposes.

Income tax – cantonal and municipal level

Thanks to the harmonization of cantonal and municipal taxes, most of the above profit determination rules apply analogously at the cantonal and municipal levels. The average tax rate on the combined actual profits of normally taxed companies is 14.7% in 2022. It varies by canton and municipality, ranging from 11.5% to 21.04%.

It is interesting to note that, unlike federal tax law, all cantonal regulations provide for special tax regimes from which taxpayers can benefit if they meet the conditions set out in the tax harmonization law.

Corporate tax reform in Switzerland

In 2019, Switzerland abolished several corporate tax regimes that were no longer internationally recognized. To maintain the attractiveness of Switzerland as a business location for companies, four compensatory measures have been put in place.

1. Reduction of income tax rates

As a result of the tax reform, tax rates on profits have been reduced in most cantons. More specifically, it is those cantons that had particularly high tax rates compared to the country as a whole that have made reductions, some of them significant.

2. “Patent Box”

The Patent Box Ordinance allows reduced taxation of the profit from a patent or comparable right at the beginning of the tax period in which the right is granted. The introduction of the patent box is mandatory for the cantons. The relief, which varies from canton to canton, can be up to 90%.

3. Additional deduction for research and development

For research and development expenses incurred in Switzerland, the cantons may apply an optional additional deduction of up to 50%.

4. Limiting relief

Each canton must impose a limit on the relief due to all alternative measures (except the special rate solution). The maximum relief may not exceed 70% of the profit, with the possibility for the cantons to define a lower limit.

Capital tax

The tax on capital is levied only at the cantonal and municipal levels. It is calculated based on the company’s net equity capital. The latter includes the share capital, open reserves, taxed hidden reserves, contribution surpluses, and legal reserves. In addition, the taxable base also includes:

- All provisions not recognized as commercially justified;

- Hidden reserves taxed;

- Debts that are economically equivalent to equity under Swiss thin capitalization regulations.

The tax rate varies between 0.001% and 0.51% depending on the canton. The cantons may grant a reduction on taxable capital arising from qualified participations, patents, and loans to group companies. Some cantons provide for the offset of cantonal income tax against capital tax.

Tax breaks

Tax breaks are granted at the cantonal and municipal levels. This is also the case at the federal level but only in certain specifically defined regions and for approved investments, with a maximum duration of ten years.

Federal level

The federal government has defined regional urban municipalities and economically disadvantaged regions. In these areas, companies can benefit from tax advantages, such as partial or total exemption from income tax for up to ten years. This measure is intended to reduce regional disparities.

Investment projects that meet certain conditions may also qualify for tax exemptions. These conditions include the creation of new jobs related to the activity and the realization of investments. In addition, these projects must meet certain criteria so as not to compete with existing businesses.

Cantonal and communal level

Most cantons offer partial or total tax relief on cantonal or municipal taxes for up to ten years, depending on the case. Relief is granted in the case of the establishment of a new business or an expansion project of certain economic importance for the canton. The practice differs from canton to canton. However, most of the tax benefits granted to companies are linked to the creation of new jobs at the local level (obligation to create between 10 and 20 jobs in most cantons).

In a nutshell: the Swiss tax system reflects the federal structure of the country. Each canton has its own tax peculiarities, which allows companies wishing to establish themselves in Switzerland to find the most suitable location for their project. The Swiss Confederation nevertheless ensures a certain harmony between the cantons to avoid undue disparities.

Greater Geneva Bern area (GGBa) is the economic promotion agency for Western Switzerland. If you would like to know more about the tax on legal entities or other subjects that could help you set up your business, contact us.

Our “Why Switzerland” articles are likely to answer your questions.