Value Added Tax (VAT) in Switzerland

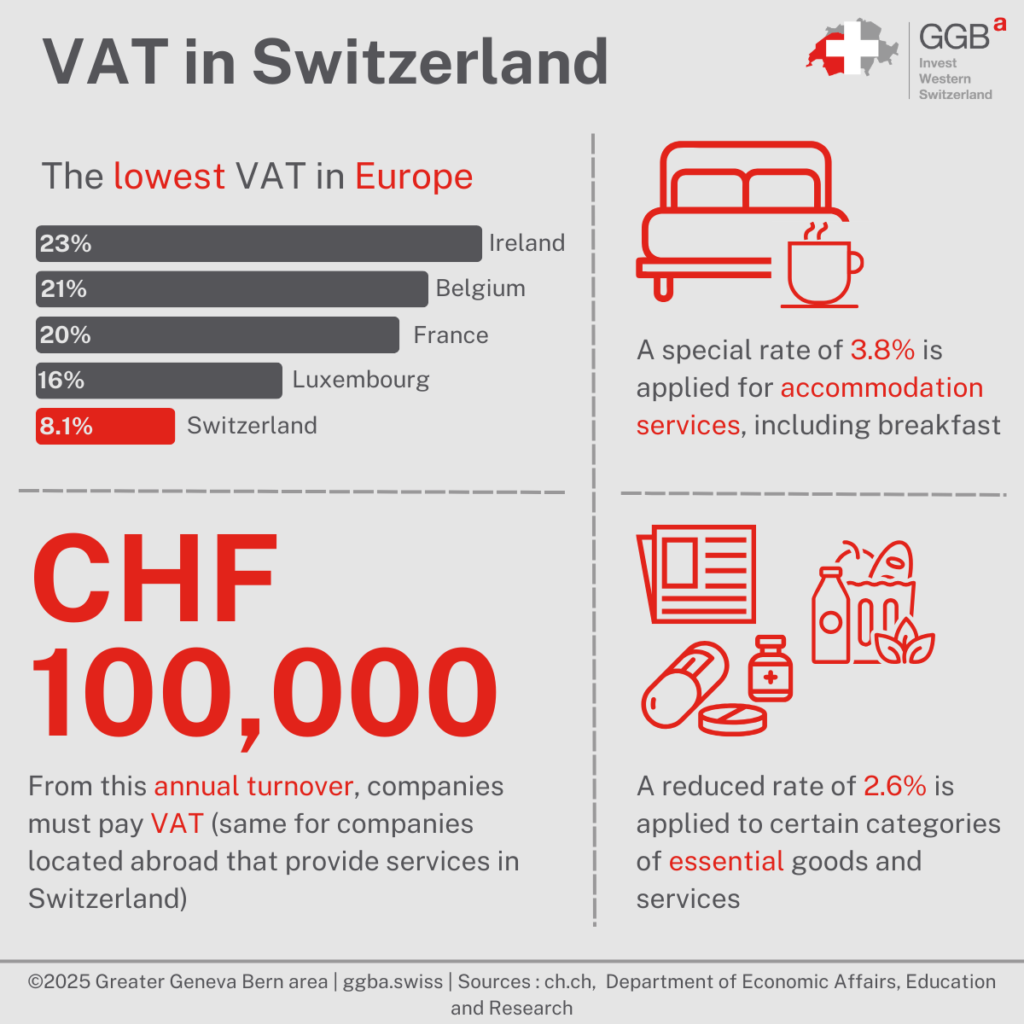

Switzerland has the lowest VAT rate among its neighbors, with a standard rate of 8.1%. To better understand how VAT is applied in Switzerland, here are the main elements to remember.

Value-added tax (VAT) is a general consumption tax collected by the Swiss government, making it an indirect tax in Switzerland. It is levied on most goods and services. It is the responsibility of the supplier to declare the tax due. VAT is calculated based on the consideration agreed upon between the parties.

Although Switzerland is not a member of the EU, its VAT system is aligned with the EU’s Sixth Directive on the harmonization of the laws of the Member States relating to turnover taxes.

Who is concerned about VAT?

The following persons who operate a business that generates income on a lasting basis through a commercial or professional activity in their name are in principle subject to tax:

- Legal entities or individuals;

- Institutions;

- Facilities;

- Communities of persons without civil capacity (i.e. regardless of legal form, purpose, and profit-making intent).

VAT registration is compulsory once a certain taxable turnover has been achieved worldwide. To be registered for VAT, the turnover must be realized with individuals or companies having their domicile or headquarters in Switzerland. All operating locations in Switzerland of a foreign company are also considered taxable persons. On the other hand, the operating sites in Switzerland and the head office abroad (and vice versa) are considered separate tax subjects.

To determine whether there is a compulsory VAT liability, the Confederation recommends filling in the VAT registration form based on the following turnover thresholds:

- For non-profit sports or cultural companies managed voluntarily: CHF 250,000 per year from services provided in Switzerland and abroad that are not excluded from taxation;

- For public utility institutions: CHF 250,000 per year;

- For public law institutions: the same conditions as for the above-mentioned sports or cultural societies;

- For public law institutions: CHF 100,000 from taxable services provided to third parties other than public authorities;

- For other companies not mentioned above: CHF 100,000 from services provided in Switzerland and abroad that are not excluded from taxation.

If none of the above-mentioned turnover thresholds are met, a company can still voluntarily register for VAT. Although this is an additional administrative burden, it can also have significant economic and fiscal advantages. This is especially true when the company is in competition with other businesses that are subject to VAT. Indeed, companies subject to VAT are entitled to deduct the input tax they have paid on the goods and services they have purchased for their business from the VAT they invoice to their customers. This allows the company to avoid paying VAT on the purchases it has made for its business, reducing its costs and offering more competitive selling prices. Therefore, to remain competitive in the market, a VAT-exempt company may decide to voluntarily submit to VAT to benefit from the deduction of VAT on the purchases it makes, and offer more competitive prices to its customers.

Holding companies that buy, hold, and sell shares in the capital of other companies are normally subject to VAT. However, if these shares represent at least 10% of the capital and are held for a long-term investment with a preponderant influence, they are considered participations and are not subject to VAT. However, since the holding activity is considered an economic activity subject to VAT, holding companies may choose to voluntarily register for VAT and waive the exemption from VAT.

Updates to VAT in Switzerland as of 01.2025

As of January 1, 2025, a partial revision of the Value Added Tax (VAT) legislation came into effect in Switzerland. This revision introduces several significant changes, including the application of VAT to electronic platforms, the extension of acquisition tax to the trade of emission rights, and new rules regarding the place of service provision for activities such as events or streaming. Additionally, the Swiss tax authority now requires all VAT registrations and declarations to be submitted through its electronic portal. These changes aim to enhance tax fairness and administrative efficiency. Businesses operating in Switzerland must adapt their processes to ensure compliance with these new regulations.

The various taxable services

VAT is charged on the following services:

- Deliveries of goods in Switzerland (including other customs territories considered national, such as Liechtenstein);

- Services provided in Switzerland (also those provided in other customs territories considered as national);

- Deliveries and services of companies based abroad;

- Imports of goods.

Services and goods supplied abroad are not subject to VAT in Switzerland. Similarly, exports of goods from Switzerland are taxable but exempt from VAT. This means that companies exporting goods from Switzerland do not have to collect VAT on these sales, but can recover the VAT paid on the costs associated with the production and export of these goods. In short, transactions that take place abroad and exports from Switzerland are not subject to Swiss VAT.

It is important to note that the supply of goods for VAT purposes is not limited to the supply of goods as defined in Swiss commercial law. The law governing value-added tax lists several transactions that are considered to be supplied for VAT purposes, such as the maintenance of machines, the rental or leasing of objects, electricity trading, etc.

VAT rates applicable in Switzerland

The standard VAT rate is 8.1% for all taxable supplies of goods and services. A special rate of 3.8% is applied to accommodation, while a reduced rate of 2.6% is applied to certain categories of essential goods and services such as

- Water distribution;

- Foodstuffs;

- Livestock, poultry, and fish;

- Grain and Seed;

The possibilities of exemptions

In Switzerland, a distinction is made between VAT-exempt sales and VAT-excluded services. In both cases, no tax is levied. However, the deduction of input tax differs between these two types of activities:

- In the case of services excluded from VAT, it is not possible to deduct the input tax incurred. Excluded activities include health care, education, culture, sports, social work, most banking and insurance activities, the rental and sale of real estate, gambling, and the rental of real estate for exclusively private use. However, for most of the excluded activities, it is possible to opt for voluntary taxation, except for banking and insurance activities as well as the rental and sale of property for exclusively residential purposes.

- For exempt activities, an input tax deduction is possible for all taxes paid in connection with the realization of the relevant turnover. These are activities where the turnover is derived, for example, from the export of goods.

In addition, services located abroad are not subject to Swiss VAT. These sales generally result from international business models. For example, if a Swiss trading company purchases products from a foreign production company and sells them to customers in a third country, the service is considered to be localized abroad. It is therefore not subject to Swiss VAT since the products are shipped directly to the customers.

The services provided abroad are eligible for an input tax deduction if they do not fall within the scope of activities not subject to VAT for which an option is excluded. This means that if the company has paid VAT on the goods it has purchased from the foreign production company, it can deduct this VAT from the tax it has to pay on its sales abroad.

Deduction of advance tax

Any person subject to VAT who acquires a service from a third party and uses it for his taxable business activity does not have to bear the burden of the tax. In other words, if the company has to purchase input products for the production of a good or a service, it is possible to deduct the VAT paid on these purchases from the VAT it has collected from its customers and which it has to pay to the state in its settlement with the Federal Tax Administration. This is called input tax.

Therefore, VAT does not constitute an additional charge for a company. It is a real cost only for the final consumer or for companies involved in transactions that are not eligible for an input tax deduction (companies engaged in activities excluded from taxation such as banking and insurance).

VAT and exports

Under Swiss VAT law, most services provided to a recipient domiciled abroad are not subject to Swiss VAT. The law provides a list of services that must be taxed at the place of business of the supplier of the services or that are subject to specific regulations, such as services related to land, hotels, services in the field of culture, sports, and arts, passenger transport services, etc.

Swiss VAT is not applied to services not included in this list that are provided to a foreign recipient. To benefit from the tax exemption, proof must be provided through documents such as invoices and agreements. The same applies to export supplies for which the tax exemption requires proof of customs export.

VAT for international activities

The VAT rules described above apply as follows to a Swiss trading company that purchases products from a foreign production company and sells them to customers in a third country, with the products being shipped directly to the customers.

In a nutshell: Switzerland’s attractive standard VAT rate and the possibility of deducting input tax create a favorable environment for companies considering locating in the country.

Greater Geneva Bern area (GGBa) is the investment promotion agency of Western Switzerland. If you would like to know more about VAT or other topics that could help you in your implantation, contact us.

Our articles “Why Switzerland” are likely to answer the questions you have.