Working in Switzerland: social security

The Swiss social insurance system places great emphasis on personal responsibility. As a result, the burden of taxes and social security contributions in Switzerland is very low compared to other countries.

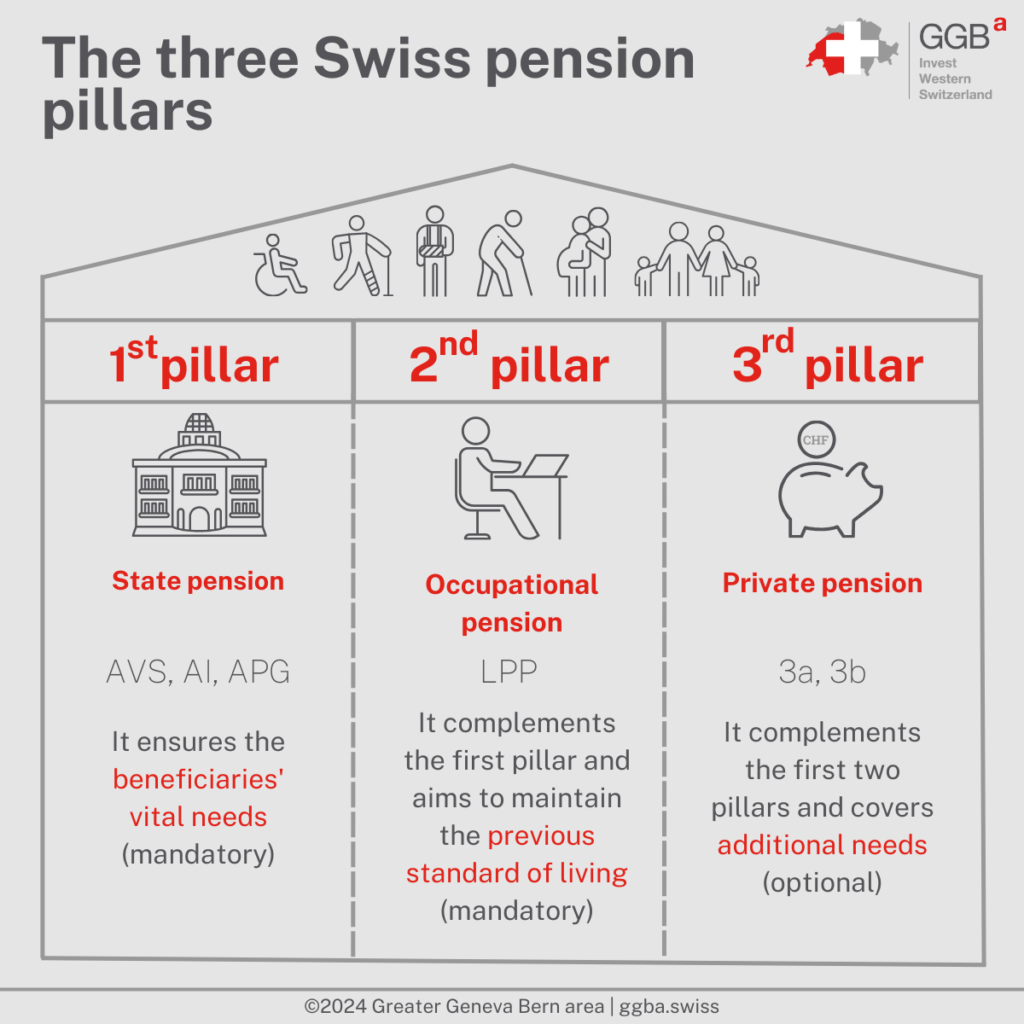

The Swiss pension system rests on three pillars:

- The 1st pillar: the vital needs of the insured are guaranteed by the old age and survivors’ insurance (AVS) and the invalidity insurance (AI). These insurances are both public, compulsory, and financed by the contributions (percentage of the salary) of the employers and the employees, as well as by taxes;

- The 2nd pillar: the occupational pension plan (LPP) complements the 1st pillar and allows one to maintain a standard of living after retirement. The occupational pension plan is financed by contributions (percentage of the salary) from employers and employees;

- The 3rd pillar: individual and voluntary pension provision for employees covers additional personal needs through savings placed with a bank or insurance company. This type of pension also offers tax benefits.

The three pillars of social insurance are supplemented by unemployment insurance (AC), loss of earnings insurance (APG) for loss of income due to military service or civil defense, continued pay in the event of maternity, and family allowances governed by cantonal legislation.

Old-age and survivors’ insurance (AVS)

The old age and survivors’ insurance pays benefits to the elderly (old-age pension) or survivors (widows’ or orphans’ pension). The pension’s amount depends on the level of the previous income and the length of the contributions. All persons who are domiciled or working in Switzerland are obliged to be affiliated with the AVS.

Individuals who are gainfully employed in Switzerland are required to pay AVS contributions, half of which are paid by employers and half by employees. These contributions represent 8.7% of the salary. The employer deducts them from the employee’s salary and pays them to the compensation fund. In the case of self-employed workers, they are responsible for all their contributions. However, they benefit from a sliding scale: below CHF 58,800 of income, the contribution rate is reduced. It is possible to calculate the amount of contributions for self-employed persons online.

People who are not gainfully employed and who live in Switzerland, such as students, invalids, pensioners, or housewives, are also required to contribute. Their contributions are determined according to their social status. It is also possible to calculate the amount of contributions for non-working people online. The old age and survivors’ insurance is thus based on the principle of distribution: the active generation finances the pensions of the elderly.

If you leave Switzerland, you are no longer required to contribute to the AVS. In some cases, for example, if you work abroad temporarily or if you work for a Swiss employer, you can, under certain conditions, continue to contribute in Switzerland. For more details on the possibilities available to you, you can contact your AVS compensation fund, the Swiss representation in your future host country or the Greater Geneva Bern area.

Invalidity insurance (AI)

Invalidity insurance aims to aid in the rehabilitation or integration of individuals with disabilities resulting from illness, accidents, or congenital conditions. A person is considered to be disabled when they are unable to engage in any gainful activity, or only partially, due to an impairment in their physical, psychological, or mental health.

A pension is only paid if rehabilitation or reintegration into working life is not possible, since rehabilitation takes precedence over the granting of a pension. This insurance is compulsory, and contributions are collected at the same time as those for the AVS.

The amount of the AI pension is calculated in the same way as the AVS pension: the amount of the pension is determined by the length of time the insured person has been insured (the period during which they have paid contributions) and the average annual income during that period. The amounts of the AI pensions are the same as those of the AVS pensions.

Health and accident insurance

Employers are obliged to insure all their employees with health and accident insurance. The latter covers all employees in Switzerland against occupational accidents, occupational diseases, and non-occupational accidents for employees working for an employer for more than 8 hours per week.

To finance health and accident insurance, a contribution is deducted from the employee’s salary. The premiums for compulsory insurance against occupational accidents and illnesses are paid by the employer, those for the compulsory insurance against non-occupational accidents are in principle paid by the employee.

Health insurance

Health insurance (also known as “basic insurance” or “compulsory health insurance”) ensures that all people living in Switzerland have access to quality health care. It offers protection in case of illness, maternity and accidents, as long as the costs are not covered by accident insurance.

Health insurance can be chosen freely. The Swiss Confederation provides a health insurance premium calculator to help you make the best choice. In addition, supplementary insurance can be taken out on a voluntary basis. Premiums are charged per person and not per income. The amount of the premium depends, among other things, on the chosen cost-sharing formula (between CHF 0 and 2,500), the chosen model and the commune of residence. In general, employers do not pay health insurance contributions.

Loss of earnings compensation scheme (APG) and maternity

The loss of earnings compensation scheme (APG) is an insurance that replaces part of the loss of income for people who perform military, civil, or civil protection service, as well as for loss of income due to maternity. It is compulsory and financed by AVS contributions paid half by the employer and half by the employee.

This allowance is a financial benefit that allows working mothers to receive 80% of their average income before birth, with a ceiling of CHF 220 per day. This benefit is paid on condition that the mother has been compulsorily insured under the AVS during the nine months preceding the birth, has worked for at least five months during the pregnancy, and is still in employment at the time of the birth. Protection against dismissal is applied during the pregnancy and the sixteen weeks following the birth. The employee cannot work during the eight weeks following the birth (work ban).

Unemployment insurance

Unemployment insurance is a system that allows workers to maintain a partial and limited income in case of unemployment and to facilitate their return to the labor market. It is compulsory for workers and is financed half by employers and half by employees (each at a rate of 1.1%). The self-employed are generally not eligible for this insurance, even voluntarily.

To receive unemployment benefits, it is necessary to prove at least 12 months of contributions (i.e., paid employment) in the two years preceding the application for benefits. EU/EFTA citizens can also benefit from this insurance, taking into account the contributions paid in their country of origin, if they work in a job subject to contributions in Switzerland after their arrival. To be eligible for UI, a person must be able and willing to accept suitable work and participate in job placement measures. The amount of the allowance is generally 70% of the salary subject to the AVS (average of the last six months, or the last twelve months of contributions before unemployment if this amount is more advantageous) or 80% for people who must support children, disabled people or people with an income of less than CHF 3,797.

The State Secretariat for Economic Affairs (SECO) provides a resource to help you qualify for unemployment insurance in case of need.

Occupational pension fund

The occupational pension funds (LPP) is a system that aims to maintain a stable standard of living for people in gainful employment by affiliating them to a pension fund managed by employers and employees. The contributions are invested in capital to be converted into an annuity or capital when the insured person retires. Insured persons are thus saving for the benefits they will receive in the future. It is estimated that the amount received at retirement, by combining both the 1st pillar (AVS) and the 2nd pillar (LPP), guarantees an income of about 60% of that earned before retirement.

Family allowances

Family allowances are intended to partially compensate parents for the costs of raising their children. To receive family allowances, you must be employed, self-employed, or not in gainful employment with an annual income not exceeding a certain amount (which depends on the canton).

In all cantons, parents receive at least the following allowances per child per month:

- An allowance of CHF 200 for children up to 16 years of age;

- A training allowance of CHF 250 for children between 16 and 25 years old.

Family allowances are not paid automatically: one has to apply for them. If you are an employee, your employer will arrange for you to receive them. If you are self-employed, you have to apply directly to your compensation fund for child benefits. Finally, if you are not working, you must contact the AVS compensation fund of your canton. It is possible to receive family allowances retroactively for a maximum of five years.

In a nutshell: Switzerland’s social insurance system provides financial protection for the people who live and work here, and their families, against risks that they could not manage on their own. These costs are low compared to other European countries and are part of a liberal culture.

The Greater Geneva Bern area (GGBa) is the investment promotion agency for Western Switzerland. If you would like to know more about social security in Switzerland or other topics that could help you in your implantation, contact us.

Our “Why Switzerland” articles are likely to answer your questions.