The Swiss franc, an indicator of the country’s general stability

In circulation for more than a century, the Swiss franc – Switzerland’s official currency – is a testament to the country’s economic, political and social stability. Considered one of the most stable and valued currencies in the world, the Swiss franc is highly sought-after in times of crisis.

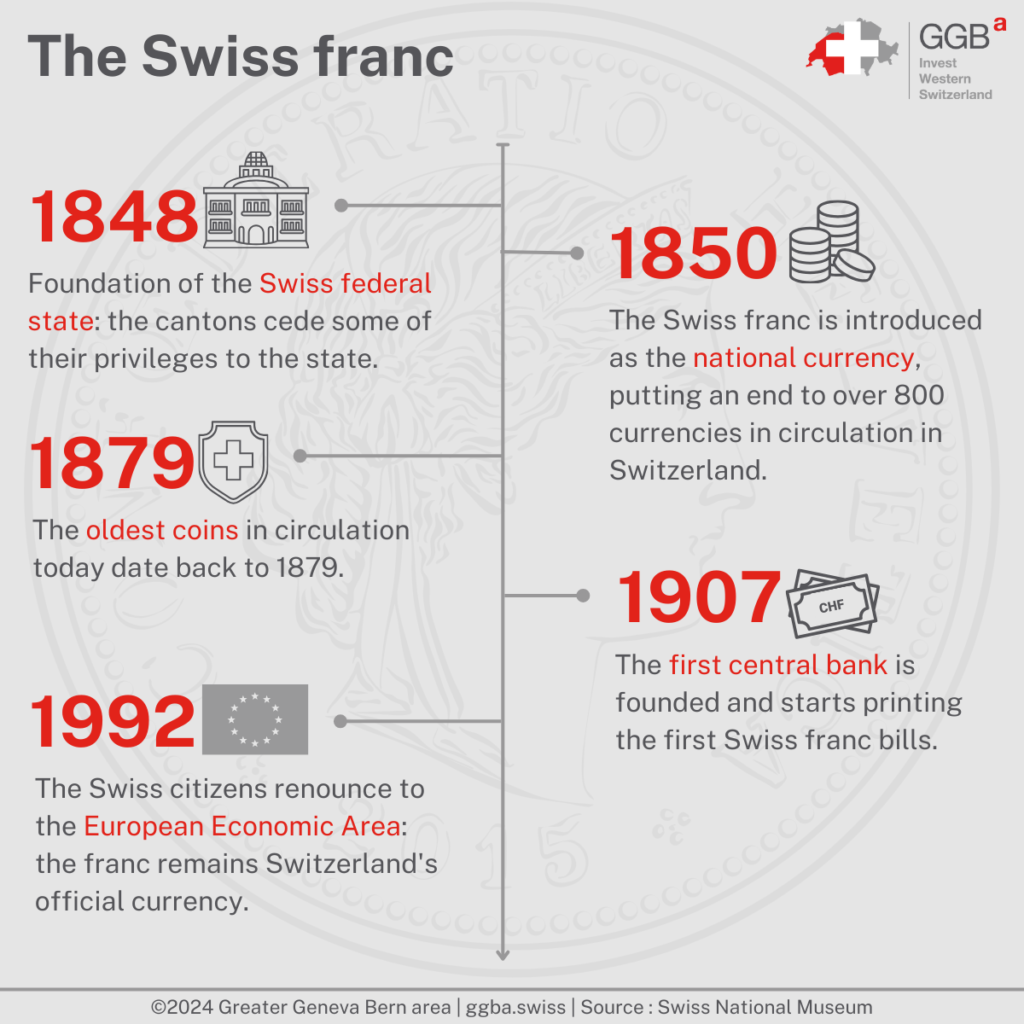

The origins of the Swiss franc

With the foundation of the federal state in 1848, the question of a single currency became central in Switzerland. A few months later, in May 1850, and after several deliberations, the new franc was introduced as the national currency. The objective behind the single currency’s introduction was (among other things) to remedy the “monetary confusion” in Switzerland, where more than 800 different currencies were in circulation. By giving the Confederation a monopoly on the minting of coins (a task now performed by Swissmint), this problem was solved and made it much easier for bankers and merchants to determine the value of a coin using scales and currency standards. 50 years later, in 1907, the first central bank was founded: it took over the printing of the first Swiss franc bills, which had not been issued until then.

Swiss franc and euro

In 1992, when Swiss citizens renounced Switzerland’s entry into the European Economic Area, they also renounced the euro, which was introduced as a single European currency on January 1, 1999. Since then, the monetary policy of the Swiss National Bank has been geared towards price stability: thanks to skillful decisions and a certain amount of luck, the Swiss franc has become an internationally recognized currency. Indeed, as Ernst Baltensperger, professor emeritus of political economy at the University of Bern points out, the Swiss franc is considered “one of the most stable and valuable currencies in the world” (Le Temps, 10.03.2012). This privileged position of the Swiss franc is the result of the country’s political, economic, and social stability. However, this report also goes in the opposite direction, as the Swiss franc’s monetary stability also contributes to the overall stability of the country. Also, by being perceived as a safe currency, the Swiss franc is highly sought-after in times of crisis. On average, over the long term, inflation in Switzerland is lower than abroad, making Swiss franc investments more attractive.

Although the euro is not Switzerland’s official currency, it is accepted in many transactions:

- The euro is accepted in most hotels and stores;

- Swiss banks and stock exchanges maintain accounts in euros;

- It is possible to withdraw euros from most Swiss ATMs;

- All bank transactions can be made in euros.

It is important to remember that the Swiss franc is the only legal tender. This means that no one is obliged to accept the euro as a means of payment. Furthermore, the prices of any service or product must be indicated in Swiss francs. It is then up to the supplier to decide if he also wants to indicate the prices in euros, but this is not an obligation.

A rarity in your pocket?

Since the Swiss franc was introduced as early as 1850, there are coins that are still in circulation today that are more than a century old. In fact, the oldest coins that can still be used as a means of payment date back to 1879. By comparison, the euro was launched in 1999, and the first coins to be put into circulation date from 2002, more than a century after the first Swiss coins. It is therefore fun to always keep a close eye on the coins you receive or use. Indeed, a 10-cent coin can be worth much more than the value indicated on it, depending on its date of issue and its condition. So be careful before you get rid of your chump change!

Although the Swiss coins have been the same for over a hundred years, the Swiss franc bills have gone through 9 different printings. The design of the latest print run introduced in 2016 was created by Manuela Pfrunder, a Swiss graphic designer. Each bill embodies a fundamental value for the Swiss people, such as humanitarian tradition, scientific vocation, or organizational skills. The history and design of the banknotes can be found on the Swiss National Bank’s website. In addition, the Swiss National Bank has also developed an augmented reality app, Swiss banknotes, which allows you to appreciate all the precision and originality of these banknotes, which you just have to scan to discover all their subtleties.

In a nutshell: the Swiss franc has been a strong currency throughout its history, reflecting the competitiveness of the Swiss economy as well as the macroeconomic and political stability of the country. The Swiss franc is also a testament to Switzerland’s ability to be close to its history and tradition while being at the forefront of innovation as coins over 140 years old sit alongside 21st-century augmented reality bills.

Greater Geneva Bern area (GGBa) is the investment promotion agency of Western Switzerland. If you would like to know more about the strength of the Swiss franc or about other subjects that could help you in your implantation, contact us.

Our “Why Switzerland” articles are likely to answer your questions.