Impaakt unveils “How Sustainable to Me” service for personalized sustainable investing

8 April 2024

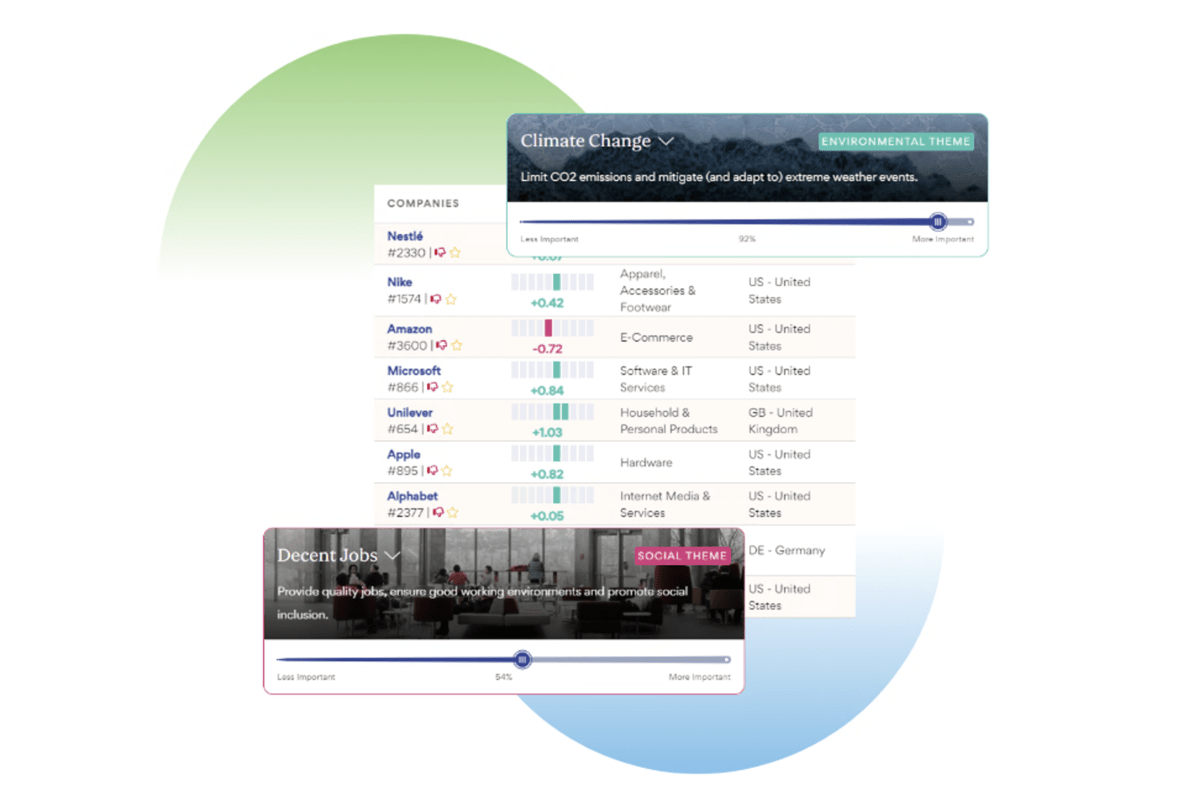

Impaakt’s platform democratizes sustainable investing by offering unrestricted access to a tool where users can evaluate and assign sustainability scores to 5,000 companies, reflecting their unique values on sustainability. | © Impaakt

Impaakt’s platform democratizes sustainable investing by offering unrestricted access to a tool where users can evaluate and assign sustainability scores to 5,000 companies, reflecting their unique values on sustainability. | © Impaakt

Geneva’s Impaakt redefines sustainable investing with a unique tool, allowing users to align investments with personal values.

Geneva-based fintech Impaakt has launched “How Sustainable to Me”, a service that aims to change the way investors assess a company’s sustainability. This cutting-edge tool empowers customers to define their criteria for sustainable businesses, moving away from the one-size-fits-all approach often dictated by banks. Available as a beta until the end of April, with a mobile version set to launch officially, this service democratizes sustainable investing by granting free access to a platform where users can assess and score 5,000 companies based on individual sustainability values.

Supported by FONGIT, Impaakt has consistently broken new ground in integrating personal sustainability criteria into investment strategies, a commitment that has drawn nearly USD 8 million in funding and fostered a community of 25,000 contributors. Their efforts have led to the development of tools that highlight companies as “Sustainability Heroes” or “Villains” from a user-centric perspective, making sustainability assessment more subjective and personal. Moreover, the platform allows for the creation of custom exclusion lists and the discovery of investment products that resonate with the user’s sustainability convictions.

A tailored approach to sustainable investing

Bertrand Gacon, CEO of Impaakt, has highlighted the dual utility of the platform: engaging companies in stakeholder impact assessment and enabling banks and pension funds to align with clients’ sustainability preferences. The service stands as a testament to Impaakt’s vision of facilitating a deeper connection between individual values and investment choices, thereby addressing the challenge of greenwashing in the investment sector.

As Impaakt gears up for the official launch, the beta phase aims to refine the platform further, based on early user feedback. This initiative highlights Impaakt’s position at the forefront of sustainability data and impact assessment while emphasizing its commitment to offering tools that enable a tailored approach to sustainable investing.