Switzerland to abolish industrial tariffs from 2024

15 January 2024

The abolishment of industrial tariffs aims to lower costs for businesses and consumers and strengthen Switzerland’s economic and industrial position.

The abolishment of industrial tariffs aims to lower costs for businesses and consumers and strengthen Switzerland’s economic and industrial position.

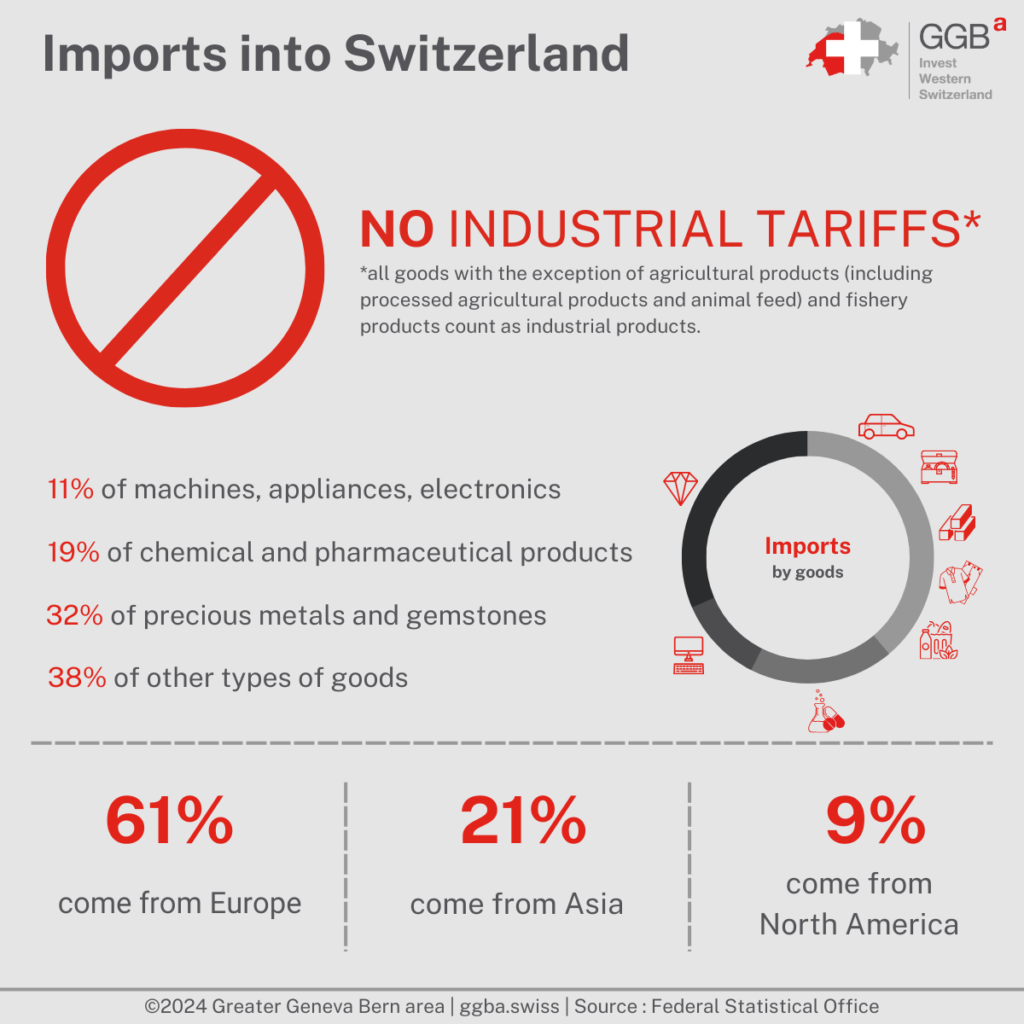

As of January 1, 2024, Switzerland will abolish industrial tariffs, a decision taken by the Federal Council following the amendment of the Customs Tariff Act.

In a landmark decision set to transform the Swiss economic landscape, the Federal Council has announced the abolition of industrial tariffs effective from January 1, 2024. This move comes following the necessary amendment to the Customs Tariff Act passed by Parliament on October 1, 2021. The decision was ratified by the Federal Council in a meeting held on 2 February 2022.

The selection of January 2024 as the commencement date aims to minimize transitional costs for both economic operators and administrative authorities. With this timeline, all concerned parties have ample opportunity to make the necessary technical and organizational preparations for this substantial shift in trade policy.

This policy change addresses a key economic challenge in Switzerland: the high cost of goods and services compared to neighboring countries. Factors contributing to this include high domestic wages and costs, as well as a range of tariff and non-tariff trade barriers that have isolated the Swiss market. These barriers have enabled companies to charge higher prices within Switzerland than abroad. The State Secretariat for Economic Affairs (SECO) has conducted a series of studies to assess the impact of these barriers, leading to the Federal Council’s decision to reduce trade barriers as part of the “Import Facilitation” package adopted on December 20, 2017.

A gateway enhanced global competitiveness

The abolition of industrial tariffs is anticipated to generate prosperity gains estimated at around CHF 860 million. Historically, these tariffs were used to protect the domestic industry from foreign competition. However, in today’s globalized economy, they have increasingly become a hindrance, inflating the cost of importing intermediate goods from abroad. The elimination of these tariffs, coupled with a simplification in administrative customs procedures, is expected to benefit Swiss companies by reducing input costs and production expenses. The overall result is an enhancement in the international competitiveness of the Swiss economy, which is deeply integrated into global value chains.

Furthermore, the policy is set to positively impact consumers. Currently, import duties are levied on various consumer goods, including cars, bicycles, personal care products, household appliances, and clothing. With the lifting of these tariffs, sectors experiencing functioning competition are likely to pass on the savings to consumers, a development that will be closely monitored.

In addition to tariff elimination, the reform includes a streamlined tariff structure for industrial products, further reducing administrative burdens. This holistic approach underlines Switzerland’s commitment to fostering a more competitive and consumer-friendly economic environment.

Learn more about the import of foreign products into Switzerland